Senate Republicans unveiled a draft tax and spending cut bill, sparking an intra-party battle over President Trump's agenda. This proposed legislation, addressing tax cuts and Medicaid, differs slightly from the House version. Agreement on identical bill text is crucial before it reaches President Trump for signature. The bill aims to make the 2017 Trump tax cuts permanent, offsetting costs with Medicaid cuts. While Republicans largely agree on extending these cuts, disagreements over specifics, particularly Medicaid provider taxes, are expected

Senate Republicans unveil a revised tax and Medicaid bill, differing slightly from the House version. This crucial legislation, aiming to make the 2017 Trump tax cuts permanent, requires identical Senate and House bills before reaching President Trump for signature. Key differences include Medicaid provider tax rates, with the Senate proposing a gradual reduction while the House favors a freeze. This "Big Beautiful Bill" faces intra-party negotiations before final passage

Republican Tax Cut Extension: 2017 Tax Cuts Face Expiration. House and Senate Republicans seek to make the 2017 Trump tax cuts permanent, offsetting costs with potential Medicaid and SNAP cuts. Congress must act before year-end to prevent a massive tax increase

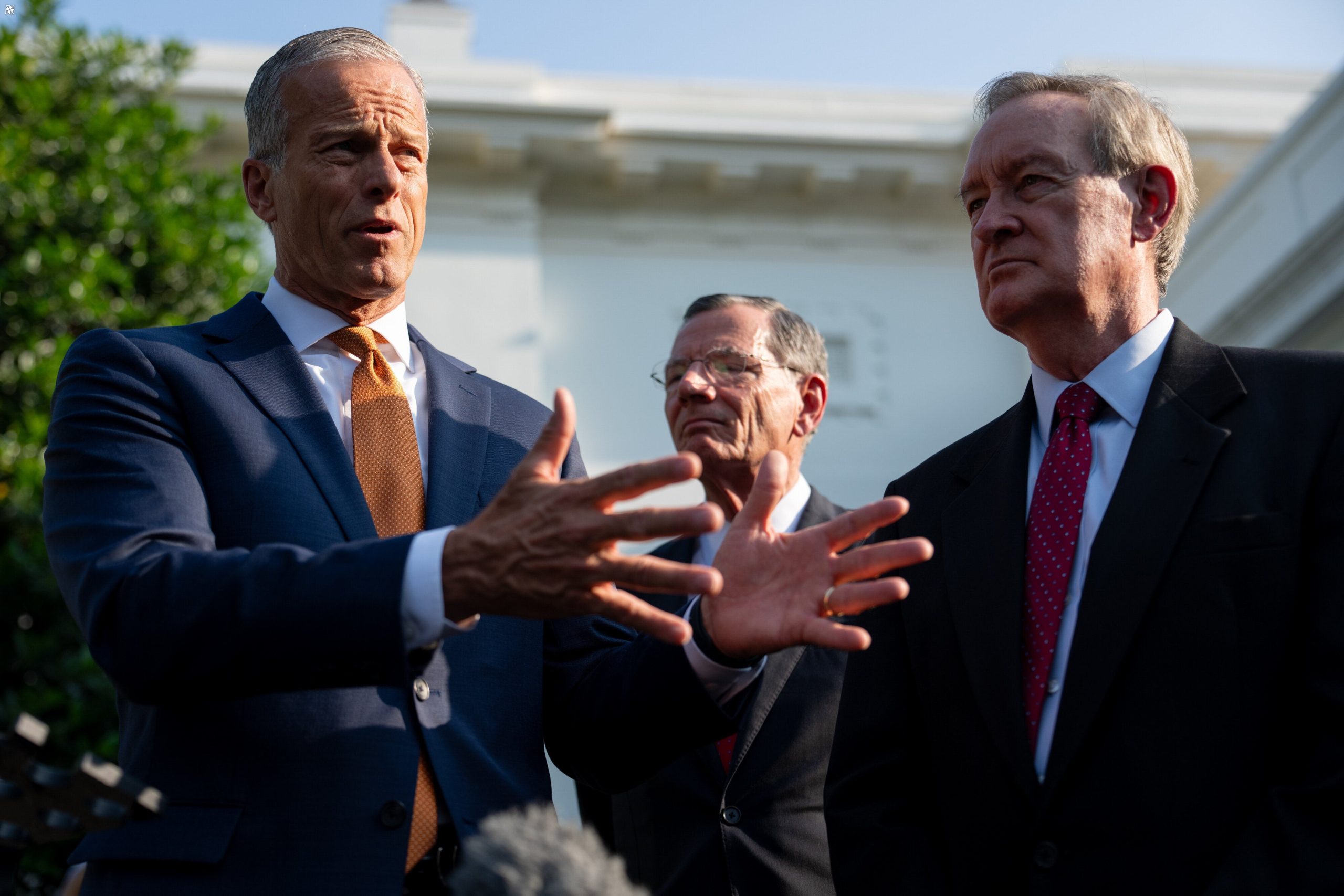

Senate Republicans unveil a bill to permanently extend the successful 2017 Trump tax cuts, preventing a $4 trillion tax increase and boosting family and business savings. This legislation, championed by Senate Finance Committee Chair Mike Crapo, aims to solidify economic growth by ensuring long-term tax certainty

Senate Republicans unveil their "Big Beautiful Bill," a tax and spending cut plan aiming to make 2017 Trump tax cuts permanent. While broadly agreeing on key elements, including Medicaid eligibility restrictions for able-bodied adults to offset costs, intra-party disagreements over specific details are anticipated, particularly concerning Medicaid provider taxes

Senate Republicans unveiled a revised tax and Medicaid bill, sparking debate over provider taxes. Unlike the House version freezing Medicaid provider taxes at 6%, the Senate plan gradually reduces the limit to 3.5%, impacting hospitals and nursing homes. This key difference in the Senate Finance Committee's proposal could significantly alter state Medicaid funding strategies. The disagreement highlights intra-party tensions over reconciling the House and Senate bills before final passage

Senate Republicans' proposed tax and spending cuts face internal conflict, with the Senate bill's stricter Medicaid provisions than the House version sparking debate. Senator Josh Hawley (R-Mo.) voiced concerns that the Senate's proposed reduction of provider taxes, from a 6% cap to 3.5%, will negatively impact Missouri's rural hospitals. This disagreement highlights key differences in the "Big Beautiful Bill" as Republicans negotiate final legislation to extend 2017 tax cuts and cut Medicaid spending

Senator Hawley voiced strong concerns about the impact of proposed Medicaid cuts on rural hospitals, urging leadership and the President to prevent closures. He emphasized preventing rural hospital closures as his key priority in the ongoing tax and spending bill negotiations

Senate Republicans, holding 53 seats, can pass their tax and spending cut bill with a simple majority using budget reconciliation. This allows for passage even with three Republican defections, with Vice President JD Vance casting the tie-breaking vote. The bill aims to make the 2017 Trump tax cuts permanent

House and Senate Republicans clash over a costly tax deduction for wealthy homeowners. A proposed increase from $10,000 to $40,000, championed by House Republicans from blue states like New York, faces opposition in the Senate. Negotiations are ongoing as lawmakers seek to reconcile differing versions of the bill before final passage

For 20 years, HuffPost has delivered fearless, truth-seeking journalism. Support our mission and help us continue uncovering vital news for the next 20 years. Your contribution keeps independent journalism alive

Unwavering commitment to factual reporting: delivering the news everyone deserves

Your support fuels our vital reporting. We're deeply grateful for your past contributions, which strengthened our newsroom during challenging times. Now, more than ever, we need your continued support to keep delivering critical news and analysis. Join us again today

Unwavering commitment to factual reporting: delivering the news everyone deserves

Your support fuels our vital reporting. We're incredibly grateful for your past contributions, which strengthened our newsroom during challenging times. Now, more than ever, we need your continued support to keep delivering critical news and analysis. Join us again today

Already contributed? Log in to hide these messages.

For two decades, HuffPost has been fearless, unflinching, and relentless in pursuit of the truth. to keep us around for the next 20 — we can’t do this without you.

Already contributed? Log in to hide these messages.

“Unless there’s at least $40,000 of SALT in the bill, it can’t pass the House,” Rep. Nick LaLota (R-N.Y.) told reporters last week.

Some Republicans in both the House and Senate have complained that the spending cuts are smaller than the tax cuts, meaning the bill would widen budget deficits and add more money to the national debt. It’s not clear if fiscal hawks would be willing to block the legislation, however.

Source: Original Article