Federal Reserve Poised for First 2025 Rate Cut: Economic Slowdown Prompts Potential Policy Shift. With inflation rising and job growth slowing, the Fed's upcoming meeting could see its first interest rate cut of the year, despite President Trump's pressure. CME FedWatch predicts a near-certainty of a cut, impacting borrowers and consumers. However, analysts warn this isn't a sign of economic strength, but rather a response to a weakening economy

Federal Reserve Poised for First 2025 Rate Cut: Wednesday's Decision Looms

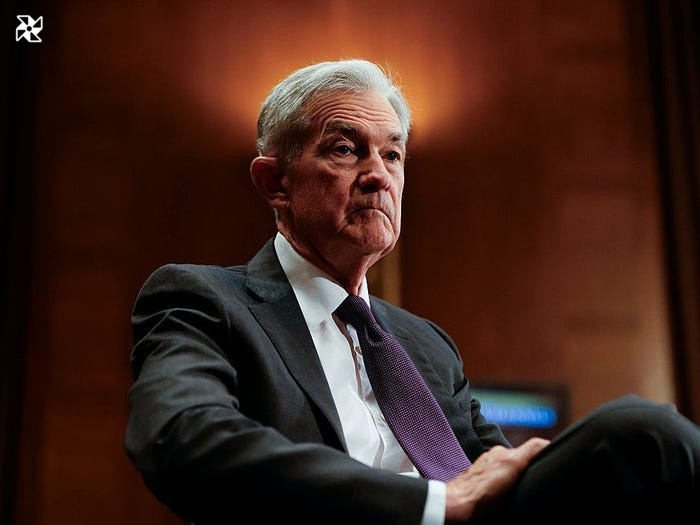

After five consecutive meetings holding steady, the Federal Reserve is expected to cut interest rates for the first time in 2025. CME FedWatch predicts a near-certain rate cut at Wednesday's meeting, despite recent economic indicators showing a mixed bag of soft job growth, rising unemployment, and resurgent inflation. President Trump's continued pressure on Fed Chair Jerome Powell adds to the drama surrounding this crucial decision. Will the cut provide needed economic relief, or signal a weakening economy? Learn more about the factors influencing the Fed's decision and its potential impact on consumers

Federal Reserve Poised for 2025 Rate Cut Amidst Economic Uncertainty: With inflation rising and job growth slowing, the Fed's upcoming meeting is anticipated to deliver the first interest rate cut of 2025. Pressure mounts on Chair Jerome Powell amidst President Trump's calls for lower rates, while Powell emphasizes the Fed's commitment to its dual mandate of maximum employment and stable prices. Will this rate cut signal economic recovery or underlying weakness? Analysis of key economic indicators, including unemployment and inflation, will inform the Fed's decision

Federal Reserve poised for first 2025 rate cut: Following soft job growth and rising inflation, Chair Jerome Powell hinted at a policy shift in his Jackson Hole speech. He cited a "curious balance" in the labor market, with slowing supply and demand, suggesting the current restrictive policy may warrant adjustment. While a rate cut could ease borrowing costs, analysts caution it may signal economic weakness rather than inflation victory. CME FedWatch predicts a near-certain rate cut at the upcoming Federal Reserve meeting

Federal Reserve Poised for First 2025 Rate Cut: Relief for Borrowers or Economic Warning Sign? With near-certainty predicted by CME FedWatch, a rate cut is anticipated, potentially easing borrowing costs for homebuyers, car loans, and credit card users. However, financial analyst Stephen Kates of Bankrate cautions that this isn't a celebration of economic strength, but rather a response to a weakening economy. The decision follows soft job growth, rising unemployment, and resurgent inflation, prompting debate and pressure on Fed Chair Jerome Powell

Federal Reserve Poised for First 2025 Rate Cut: Faltering Economy, Not Inflation Victory

Despite near-certain predictions, a potential Federal Reserve interest rate cut isn't cause for celebration. This move, driven by a weakening economy and softening job growth, signals economic fragility rather than inflation's defeat. While offering relief to borrowers, the cut highlights concerns about slowing economic activity and underscores the complexities facing the Fed in balancing maximum employment and stable prices

Federal Reserve Poised for Rate Cut: Economic Indicators to Determine Decision

The Federal Reserve's upcoming interest rate decision hinges on key economic indicators directly impacting consumers. Factors like slowing job growth, unemployment, and rising inflation will heavily influence the outcome of Wednesday's meeting, where a rate cut is highly anticipated

Inflation Surges to 2.9% as Fed Poised for Rate Cut: August's Consumer Price Index (CPI) jump marks the highest year-over-year increase since January, fueling speculation of an imminent Federal Reserve interest rate cut in 2025. This follows softening job growth and a decline in consumer sentiment, raising concerns about economic slowdown despite GDP recovery

US job growth slows dramatically, raising concerns. July and August job numbers fell far short of expectations, following a June revision showing the first job loss since December 2020. While unemployment remains historically low, hiring freezes and limited white-collar opportunities signal a weakening labor market, impacting both employers and job seekers. This sluggish job market is a key factor influencing the Federal Reserve's anticipated interest rate cut

Federal Reserve Poised for First 2025 Rate Cut: Will Economic Slowdown Force Powell's Hand? Amidst slowing economic growth, near-full employment showing signs of weakening, and rising inflation, pressure mounts on Fed Chair Jerome Powell to cut interest rates. While previous meetings maintained steady rates, dissenting opinions from governors Waller and Bowman highlight concerns about the need for stimulus. This crucial decision, predicted with near certainty by CME FedWatch, will impact borrowers and consumers, though analysts caution against viewing a rate cut as a sign of economic strength. The Fed's dual mandate of maximum employment and stable prices will guide the decision, weighing factors like soft job growth and the impact of Trump's trade policies

Federal Reserve poised for first 2025 rate cut: Investor anticipation high after Powell's Jackson Hole signal. Markets rallied following Powell's speech, with many investors demanding at least a 0.25% reduction. Will the Fed deliver?

Federal Reserve Rate Cut Expected: Relief for Borrowers, but Economic Concerns Remain. While a near-certain interest rate cut is anticipated, its impact on consumers may be limited, according to financial analysts. The decision follows weakening job growth and rising inflation, prompting debate about the true economic implications of lower rates

Federal Reserve Rate Cut: Impact on Mortgages, Auto Loans, and Credit Cards. The Fed's potential interest rate cut could affect your borrowing costs for 30-year fixed mortgages, 2-year auto loans, and credit cards. While the federal funds rate influences these rates, inflation and investor sentiment also play a significant role. Changes in the Fed rate don't always immediately translate to consumer loan rates; the impact can be gradual

Financial analyst Stephen Kates cautions against viewing a potential September Fed rate cut as an economic victory. While a near-certain cut is anticipated, Kates explains that some rate reduction is already priced into the market, meaning the actual impact may be less dramatic than expected. This potential cut reflects a weakening economy, not necessarily a sign of robust economic health

Mortgage rates are cooling this summer, with 30-year fixed-rate mortgages showing a significant decrease. This trend follows potential Federal Reserve rate cuts in 2025, impacting borrowing costs for homes, cars, and other loans

Federal Reserve Rate Cut: Good News for Borrowers, But What About Savers? A potential interest rate cut by the Federal Reserve could offer relief to borrowers facing high debt, making loans and credit more affordable. However, this could also mean lower returns on savings accounts and CDs. Experts warn this isn't necessarily a sign of economic strength, but rather a response to slowing growth. Learn how a rate cut could impact your personal finances

Federal Reserve rate cuts often lead to lower credit card interest rates, but this reduction may take several months or billing cycles to fully impact your statement

Any substantial changes in borrowing costs for consumers would likely come from multiple rate cuts over the coming months, not the single September decision. Mark Hamrick, Bankrate’s senior economic analyst, said that a smaller 25-basis-point cut “would not have hugely consequential implications for the lives of most Americans” since the benchmark would still be restrictive.

A Federal Reserve rate cut, potentially arriving as early as this week, could significantly impact the economy. While some see it as a positive sign, boosting the housing market and easing economic pressures, others caution that it might signal underlying economic weakness rather than a victory over inflation. This pivotal decision hinges on recent economic data showing slowing job growth and rising inflation, prompting debate about its true meaning for consumers and the housing market

The Trump administration has been pushing for a rate cut for months, with the president often posting criticism of Powell online.

“Jerome ‘Too Late’ Powell should have lowered rates long ago,” Trump wrote in a September 5 Truth Social post. “As usual, he’s ‘Too Late!'”

The president has also encouraged Powell to resign and spoken about firing him, though economists previously told Business Insider that an unexpected change in Fed leadership would send markets spiraling. Powell’s official term ends in May.

Other members of the Fed have been under pressure, too. Trump recently called on Fed Governor Lisa Cook to resign, alleging that she committed mortgage fraud. Her attorneys denied the allegation, and Cook remains in her seat. A Reuters report on September 13 found that documents showed her second property was listed as a vacation home, not a primary residence, contrary to the allegations.

The president also has a say in replacing Fed Governor Adriana Kugler, who announced her resignation in August. Trump nominated Stephen Miran, the chair of the White House’s Council of Economic Advisors, to be her replacement. Trump’s additions to the Fed’s open market committee could give the White House more sway in monetary policy over time.

Source: Original Article